- Blog

- EUR1 document - All You Need to Know

EUR1 Document - All You Need to Know

Learn what the EUR1 document is, when it can reduce customs duty, what proof of EU origin you need, and how to obtain the document when exporting cars outside the EU.

As a dealer, your aim is always to minimize your costs and maximize your profits. If you sell cars originating in the EU to buyers outside the EU, you may have heard that customs duties can sometimes be reduced.

For that, you’ll need the EUR1 document.

In this article, you’ll learn what the EUR1 document is, when it applies, and what you should know before relying on it, so you can plan your sales and exports with fewer surprises.

Kluczowe wnioski

- EUR1 can reduce customs duty, but only for certain countries and cars.

- To obtain the EUR1, you need proof of EU origin (often a COO or exporter declaration).

- You can get the EUR1 through a transit company, or request it from customs in some cases.

- Always check the destination country’s rules before you rely on EUR1.

What is a EUR1 Certificate?

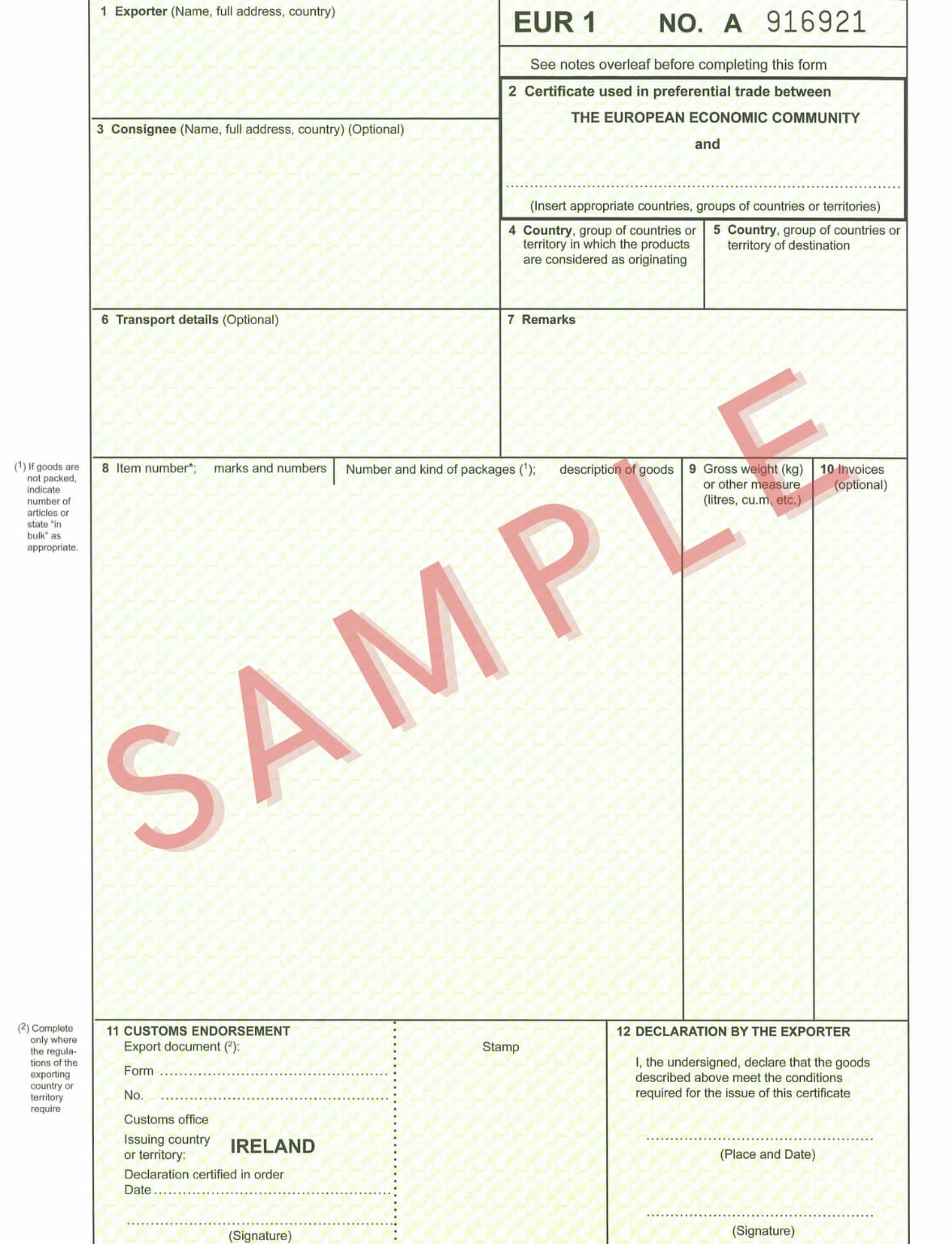

The EUR1 certificate, also called the movement certificate, is an official document that customs authorities use during export and import.

It proves that a product, in this case a car, has preferential EU origin under certain trade agreements with non-EU countries.

When customs in the destination country accept it, the importer may benefit from reduced or zero customs duty.

This means the car must qualify as EU-origin under the trade agreement between the EU and the importing country.

For example, if you’re exporting to Serbia, customs apply the rules of the EU and Serbia Stabilisation and Association Agreement when checking the EUR1.

It’s important to remember that the EUR1 does not apply to every EU-registered car and does not guarantee a duty reduction in all cases.

Example of a EUR1 certificate

► Who issues it?

When you’re exporting cars from the EU, you can obtain some documents yourself. Some documents, like the EX-A export declaration, are prepared by your seller.

So, who issues the EUR1 certificate?

In practice, specialized customs or transit agencies prepare the EUR1.

These are often the same agencies that handle temporary or transit plates for exported vehicles.

Many eCarsTrade buyers have successfully worked with A-Telma, a Brussels-based transit company, and obtained their EUR1 documents.

In Belgium, you can choose from several transit and shipping agencies:

❗Disclaimer: Keep in mind that services can vary a lot depending on the agency. Some may not handle road transport or used passenger cars. Still, these are established transit agencies in Belgium, so it’s worth contacting them to check if they can handle your transport and arrange the EUR1.

eCarsTrade could not verify the possibility of obtaining the EUR1 from any of the other agencies besides A-Telma.

After the EUR1 is issued, authorities then check and validate it at the border, which makes it officially valid.

In some cases, you can request the EUR1 directly from the customs office in the exporting country.

Under the Pan-Euro-Med (PEM) rules, customs authorities are the ones who issue the EUR1 when the exporter requests it and provides proof of origin.

The process can differ depending on the country. Generally, it may be safer to arrange the EUR1 through an experienced transit/customs agency, or check the exact requirements with customs before import.

Why does the EUR1 certificate matter for car dealers?

This document isn’t easy to obtain, but many dealers still make the effort to get it because it can significantly reduce import costs.

Exporting cars from EU to non-EU countries can get expensive, as standard customs duty on imported cars is often between 10% and 15% of the car’s value. That’s why most dealers focus on EU-EU imports.

But if a document like the EUR1 can reduce import duties to 0%, exports outside the EU become more profitable.

Because of this, you’re no longer limited to local markets.

You can buy cars across the EU and resell them abroad to buyers in countries where high import costs would otherwise make EU cars too expensive.

List of countries that accept EUR1 document

A common question about the EUR1 is: Which countries require the EUR1 certificate?

The EUR1 is accepted only in countries that have a preferential trade agreement with the EU.

Rules can change over time, so you should always check if there’s an agreement with the destination country before relying on the EUR1.

Here’s a list of countries with trade agreements that may accept the EUR1, grouped by region.

|

Region |

Country |

Helpful links |

|

Europe (non-EU members) |

North Macedonia |

|

|

Montenegro |

||

|

Serbia |

||

|

Albania |

||

|

Bosnia and Herzegovina |

||

|

Kosovo |

||

|

Switzerland |

||

|

Norway |

||

|

Middle East & North Africa |

Israel |

|

|

Jordan |

||

|

Lebanon |

||

|

Algeria |

||

|

Tunisia |

||

|

Morocco |

||

|

Egypt |

||

|

Eurasia |

Moldova |

|

|

Georgia |

Remember, if you see that your destination country is on this list and has a trade agreement with the EU, that’s still not a guarantee that their customs will accept the EUR1 for reduced duty.

❗You should always confirm the rules with the local customs before import!

EU countries - EUR1 not needed for EU members

If you’re trading cars between EU members, you don’t need the EUR1. Goods move freely within the EU, and no customs duty applies.

Vehicle requirements for EUR1

If you want to obtain the EUR1, you’ll have to prove that the car was manufactured in the EU.

For this, you’ll need a declaration from the exporter that confirms the EU production, or an official document from the car’s manufacturer.

In case of the exporter’s declaration, the exporter vouches that the car was produced in the EU.

Not many exporters want that legal responsibility, so this is not an option you should count on.

You may have better chances if you can obtain a Certificate of Origin (COO) from the manufacturer or the exporter.

The transit agency can then use the COO when applying for the EUR1.

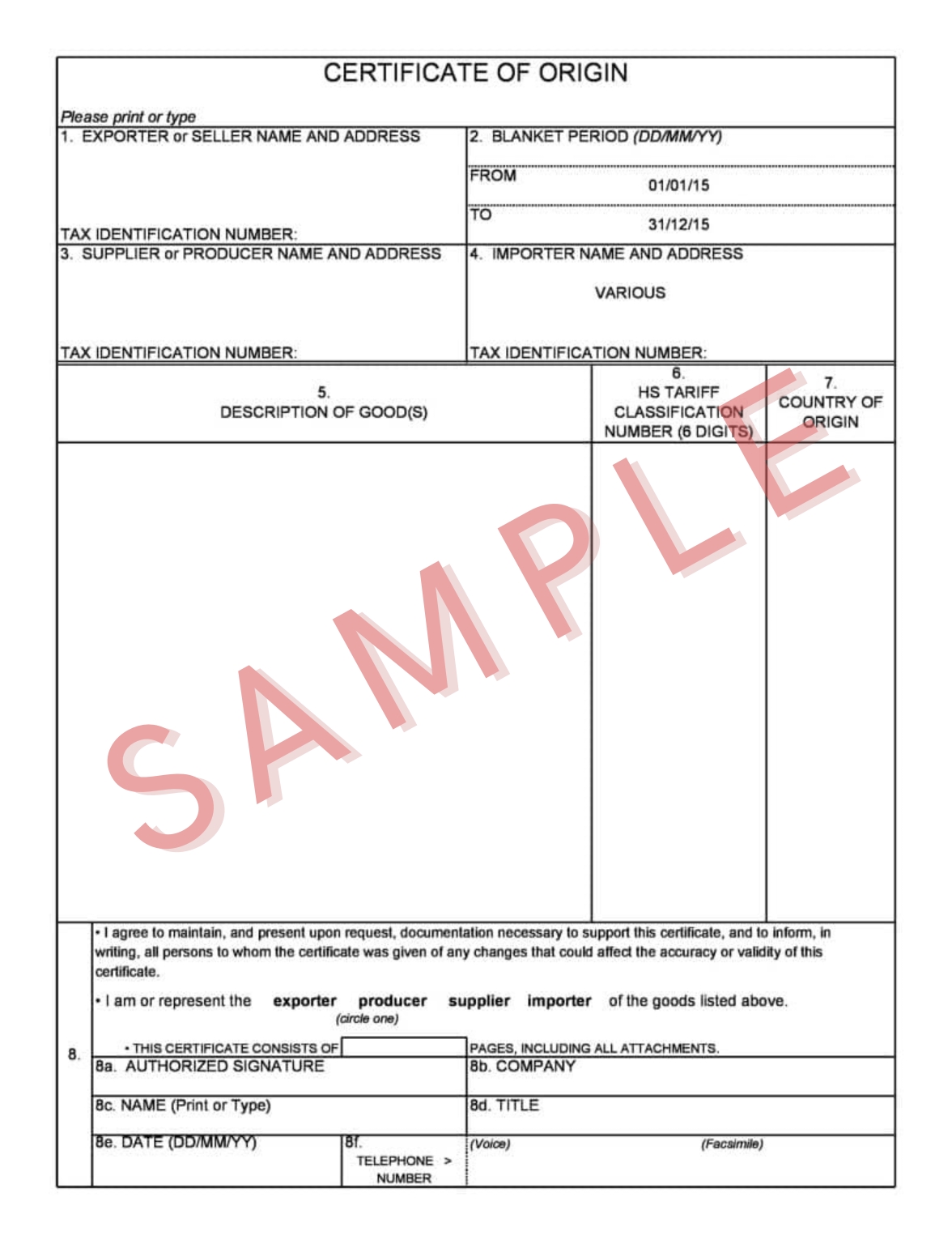

Example of a Certificate of Origin (COO)

COO as an alternative

Certificate of Origin (COO) is also a document that confirms where the car was manufactured, but it’s not the same as the EUR1.

On its own, the COO won’t automatically grant you the reduced customs duty.

However, a COO can be very useful because it can serve as proof of EU production when applying for a EUR1.

If you have a COO from the manufacturer, a customs or transit agency can often use it to request and validate a EUR1 with customs.

In some cases, you may also be able to request a COO through the supplier you’re buying from. Availability of the document depends on the car and the supplier’s process.

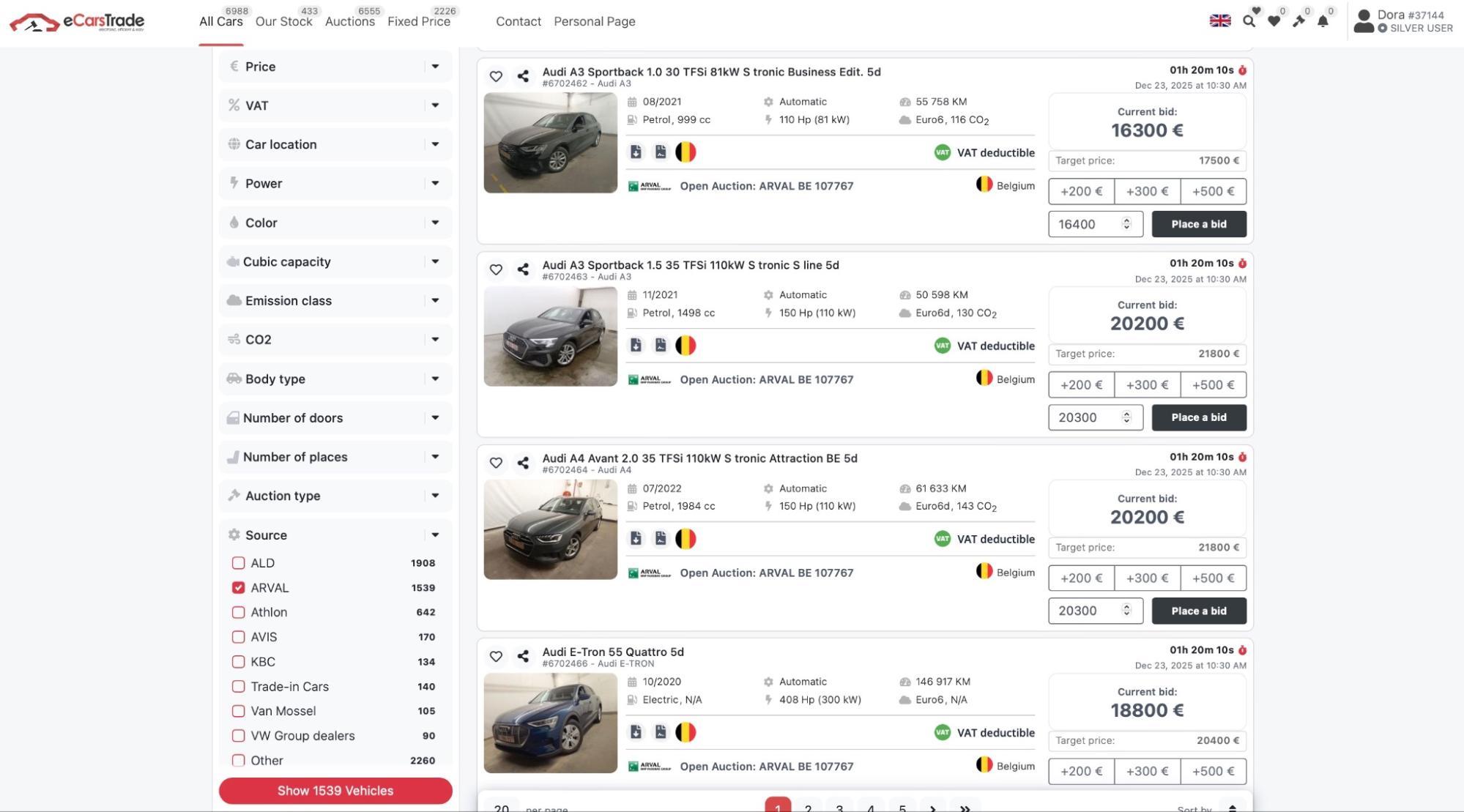

For instance, if you’re buying ex-lease cars from Arval on eCarsTrade, you can sometimes receive a COO from Arval. Simply inform us and we can request it from Arval on your behalf.

You can find Arvals cars by filtering the auctions by Source and selecting Arval as the supplier.

So, getting a COO can be the first step towards obtaining the EUR1. Still, you should keep in mind that:

- Not every car manufacturer issues a COO

- Availability depends on the brand and the car

For instance, our clients have noted that obtaining the EUR1 is not possible for German cars because German cars don’t provide COOs.

On the other hand, brands like Volvo may issue COOs for certain models, usually at a cost of around €150.

All in all, it’s best to use the COO as a supporting document, not the replacement for the EUR1, unless a country specifically states that having a COO is enough to reduce the customs duty.

This brings us to another scenario worth mentioning:

Some countries with EU trade agreements will accept a statement of origin for cars under €6,000.

In these cases, you may be able to pay a reduced customs duty or avoid it altogether, without needing a EUR1.

How to obtain a EUR1 Certificate?

Here’s how to get the EUR1 in general. The exact process depends on the exporting country and the destination country, so the steps below are a general guide.

1. Confirm the destination country’s trade agreement

The first step is to check if the country you’re exporting to has a preferential trade agreement with the EU and if EUR1 is accepted there.

2. Decide which origin proof you will use

Check if you can obtain a Certificate of Origin (COO) or a different origin document, or if an exporter declaration is available.

To do this, you’ll have to contact either:

- The exporter,

- A transit agency,

- Or the car’s manufacturer.

3. Prepare the export paperwork

If you’ve obtained the COO and decided to request the EUR1 from a transit agency, you’ll have to prepare the following documents:

- Vehicle purchase invoice

- Registration papers

- ID or passport of the importer

- COO (or a different proof of origin that your agency accepts)

4. Request the EUR1 through a customs or transit agency

A customs or transit agency prepares the EUR1 form.

The agency then submits the EUR1 to customs in the exporting country.

5. Customs validation in the exporting country

Customs authorities will check the EUR1. If they accept it as proof of EU origin, they’ll validate the document.

6. Present the EUR1 at import

When you import the car to the destination country, you will have to present the validated EUR1 to customs during import clearance.

Customs use this document to decide if reduced customs duty applies.

7. Pay customs duty

How you’ll pay the duty depends on the destination county.

In some countries, an accepted EUR1 means that you’re paying no customs duty on import.

In other countries, such as Bosnia and Herzegovina, customs require you to pay a 10% customs duty deposit at import, even if you provide a valid EUR1.

In many cases, you’ll get the refund of this amount later when they process the EUR1, but refunds are not automatic and can take time.

So, you should check in advance how duty payments work in your destination country.

8. Keep document copies

After import, keep copies of the EUR1 and all supporting documents because customs authorities may request additional checks later.

Planning imports with the EUR1

Obtaining the EUR1 does take a bit of effort, but once they validate the document at the customs, the car becomes more cost-effective to import.

However, the most important thing with the EUR1 document is to check the car’s eligibility in advance.

Always confirm if the destination country accepts the EUR1, if the car can qualify as EU-origin, and if the required origin documents are available for that specific car and brand.

That way, you can plan your costs realistically and avoid surprises during import.

Nasz bogaty asortyment obejmuje różne marki i modele, aby odpowiedzieć na wszystkie Twoje potrzeby, pozyskiwane bezpośrednio od renomowanych europejskich firm leasingowych, firm wynajmu krótkoterminowego i dealerów:

_01JE9WH8CRTMG3B3WDH56WNJHD.png)