- Blog

- How to Import a Used Car to Bosnia and Herzegovina

How to Import a Used Car to Bosnia and Herzegovina

Learn how to import a car to Bosnia and Herzegovina. In this guide, you’ll find everything from required documents to car transport and customs clearance.

Are you considering importing used cars to Bosnia and Herzegovina?

If so, you’re onto an excellent business idea, as the used car market there is much larger than the new-car market. Also, it relies heavily on imports from the EU.

Buyers are looking for well-maintained, affordable vehicles, and most dealerships source their cars abroad to meet demand.

To help you plan your next purchase, here’s an overview of what you can import, the documents you’ll need, and the main costs to expect when bringing a used car into Bosnia and Herzegovina.

Import regulations of Bosnia and Herzegovina

Although older cars dominate the car market of Bosnia and Herzegovina, there’s one important rule that limits what you can now import.

While there’s no specific car age limit, you’re only allowed to import vehicles that meet at least the Euro 5 emission standard. Older Euro 3 and Euro 4 cars can’t be brought in for regular registration.

Essentially, the Euro 5 requirement is the key rule to keep in mind, meaning you can import a wide range of younger EU vehicles as long as they meet this standard and pass homologation.

Documentation for importing a vehicle to Bosnia and Herzegovina as a business

Preparing all the necessary documents in advance helps you import more efficiently. So, here’s a list of documents you’ll need.

► Vehicle purchase invoice

To prove that you legally own the car you’ve bought, you’ll need the vehicle purchase invoice.

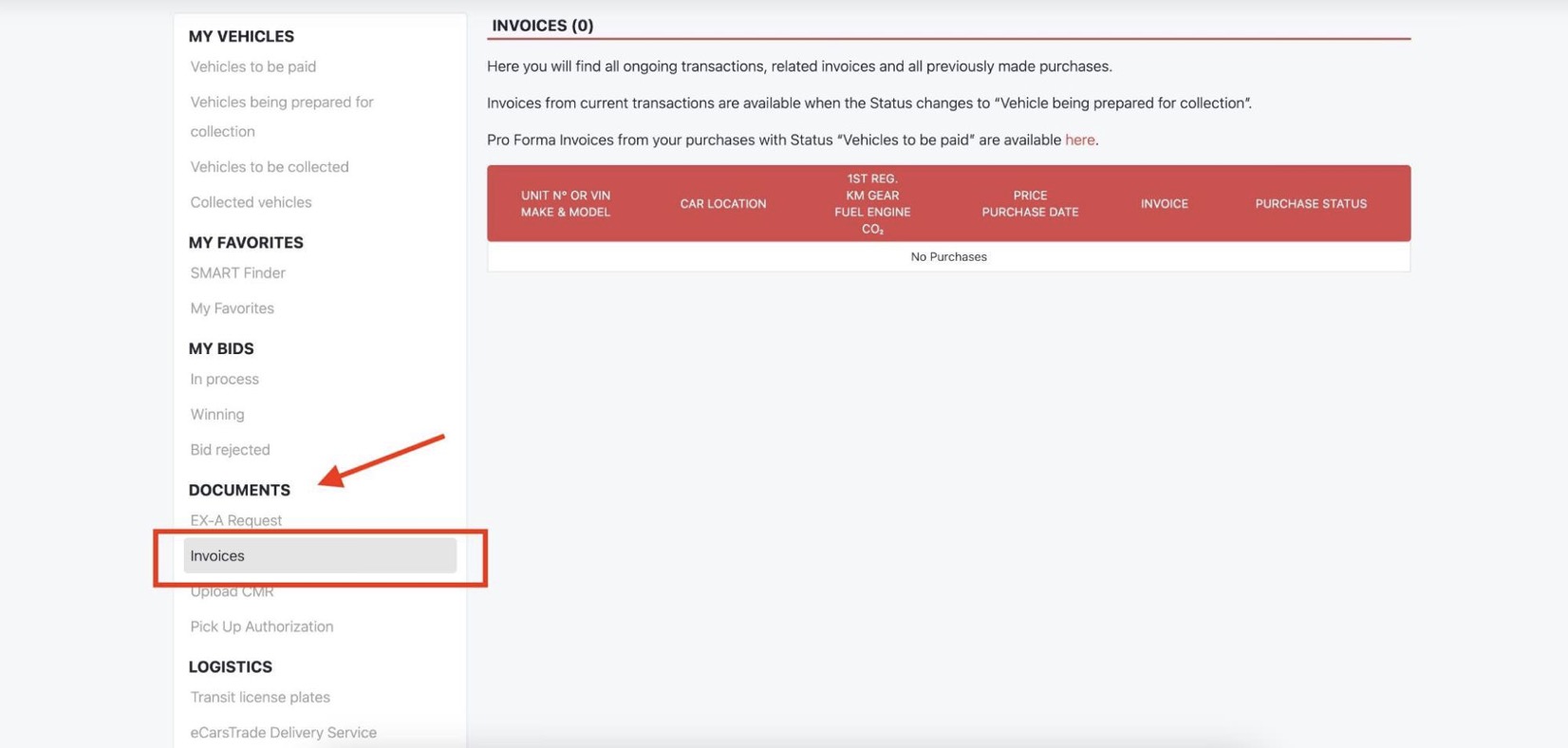

If you’ve bought the car on eCarsTrade, you can access your invoice on your Personal Page.

Car purchase invoices should contain details like the seller’s information, the buyer’s information, the vehicle’s VIN, make, model, mileage, sale price, and the date of purchase.

► Original registration papers

Original registration papers are also required. You’ll also use these to confirm the car’s Euro standard, since the registration certificate usually lists the emission class needed for import and homologation.

All cars on eCarsTrade are sold with original registration papers included, so you’ll already have everything you need to prove the emission class.

► EUR1 certificate

Next, you can try to obtain the EUR1 certificate because it allows you to claim duty-free import for vehicles that come from the EU.

The customs authority requires proof that the car is of EU origin, and the EUR1 is the standard document for this.

In certain cases your seller can possibly provide a statement of origin. This has the same purpose and is accepted as proof of EU origin.

Without either the EUR1 or the statement of origin, you’ll need to pay full customs duty during import.

❗At eCarsTrade, we are not able to provide the Certificate of Origin or the EUR1, but we can refer you to a transit agency in Brussels who can give you further information on how to obtain them.

❗Several Reddit users who have imported used cars to Bosnia and Herzegovina claim that EUR1 is difficult or even impossible to obtain for most cars, in which case you’d have to pay the full duty.

There have also been cases where an EUR1 was provided, but customs still did not grant the reduced duty rate, meaning the importers had to pay the full amount anyway.

Always check with your seller or auction platform in advance to confirm if the EUR1 or the statement of origin will be available for the specific car you want to buy.

► Export declaration (EX-A)

Every car leaving the EU needs an EX-A export declaration.

This document confirms that the vehicle has officially left the EU, and both EU customs and the Bosnian customs authority use it as proof of export.

Your EU seller or the exporting company will prepare the EX-A, and you’ll present the validated declaration during customs clearance in Bosnia and Herzegovina.

Taxes when importing a car to Bosnia and Herzegovina

To make your imports profitable, you should understand what taxes you’ll pay at the border. Here’s a simple overview to help you estimate your final costs before placing a bid.

Important to know:

When calculating taxes, customs don't rely only on the purchase price shown on your invoice.

Instead, they check the car in the official valuation database based on its make, model, engine, year, and equipment, and use this catalog value as the basis for tax calculation.

If the catalog value is higher than your invoice price, taxes will be calculated on the higher amount.

Customs duty

Bosnia and Herzegovina normally charges 15% customs duty on imported passenger cars.

You can avoid this duty if your car qualifies as an EU-origin vehicle and you provide either:

- a valid EUR1 certificate, or

- a Certificate of Origin (COO) / statement of origin

If you don’t have either of these documents, customs will apply the full 15% duty.

VAT (PDV)

After customs duty is calculated, you’ll pay 17% VAT on the total customs value of the vehicle.

This means VAT is charged on:

- the car’s catalog value

- plus transport costs to the border

- plus any customs duty (if applicable)

Remember that VAT is always charged, even if a car is duty-free because of its EU origin.

Step-by-step process - from purchasing a car to importing it to Bosnia and Herzegovina

Now, let’s look at the steps you’ll take from buying a used car to registering it.

You can also find a detailed description on the official website of the Indirect Taxation Authority of Bosnia and Herzegovina.

1. Choose and buy the car

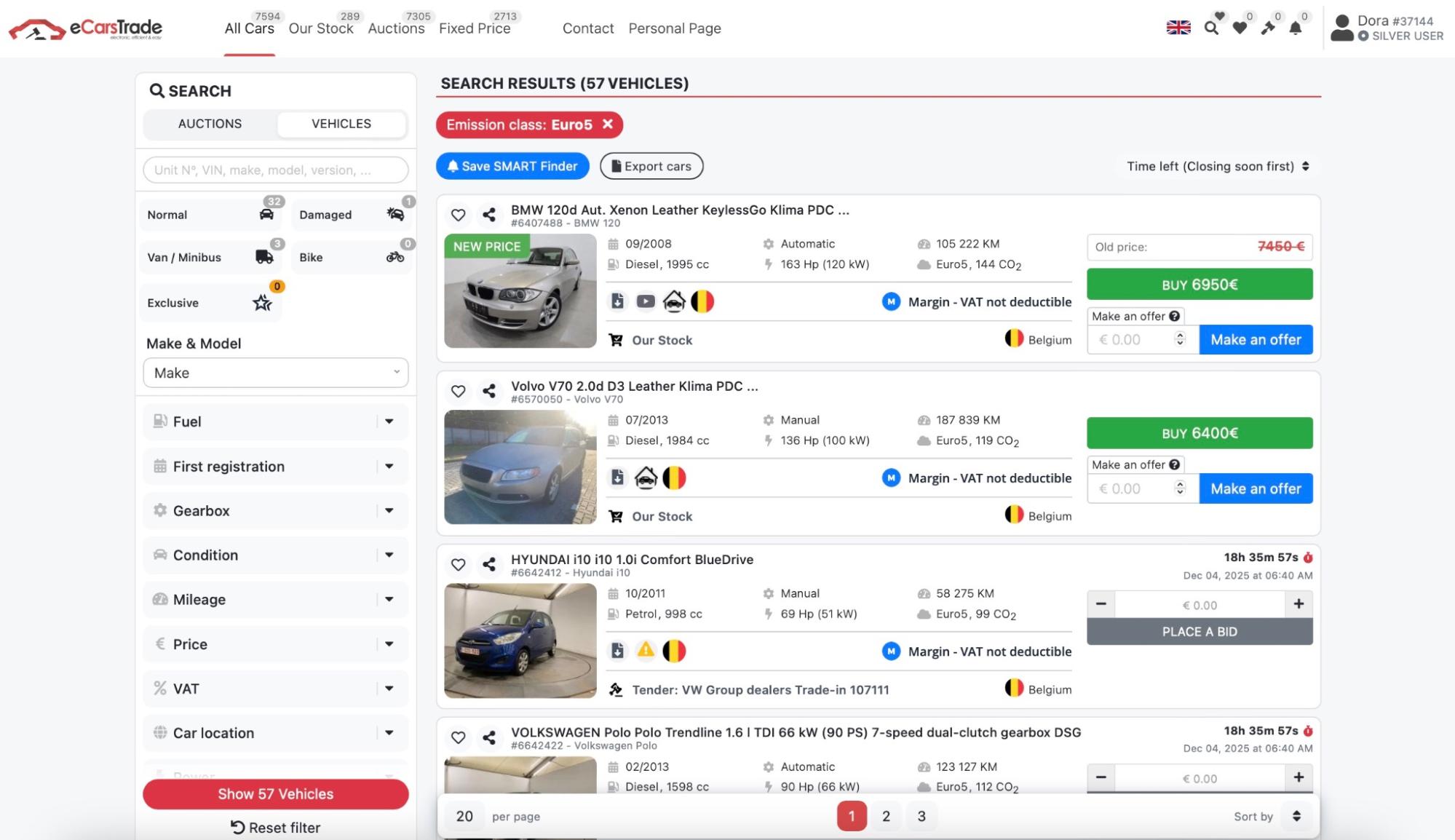

Since only Euro 5 or newer cars can be imported, you should start by searching for vehicles that meet this requirement.

On eCarsTrade, you can use the Emission class filter to narrow your search and find only the cars that are eligible for import to Bosnia and Herzegovina.

After you’ve placed your bid and won a car, you’ll pay the purchase price, and we’ll issue the invoice.

2. Arrange transportation

Then, you’ll choose between driving the car yourself, or shipping it via a transport company.

Remember that if you’re driving the car, you’ll need to arrange transit plates from the seller’s country and make sure you have valid insurance for the trip.

eCarsTrade offers delivery straight to your parking lot - contact us for a custom delivery quote!

3. Request EUR1

To avoid paying customs duty on EU vehicles, you can request the EUR1 certificate or the certificate of origin.

However, the seller is often not able to provide these documents. In that case, you can try contacting a transit agency or a specialized import agency to help you with the process.

A Certificate of Origin (COO) is often accepted instead of the EUR1, which you can often obtain through the brand directly.

If you don't have the EUR1 or the COO, you will have to pay the full 15% customs duty during import.

4. Request the EX-A declaration

Next, ask your seller or the exporting company to prepare the EX-A export declaration. This document proves that the vehicle has officially left the European Union.

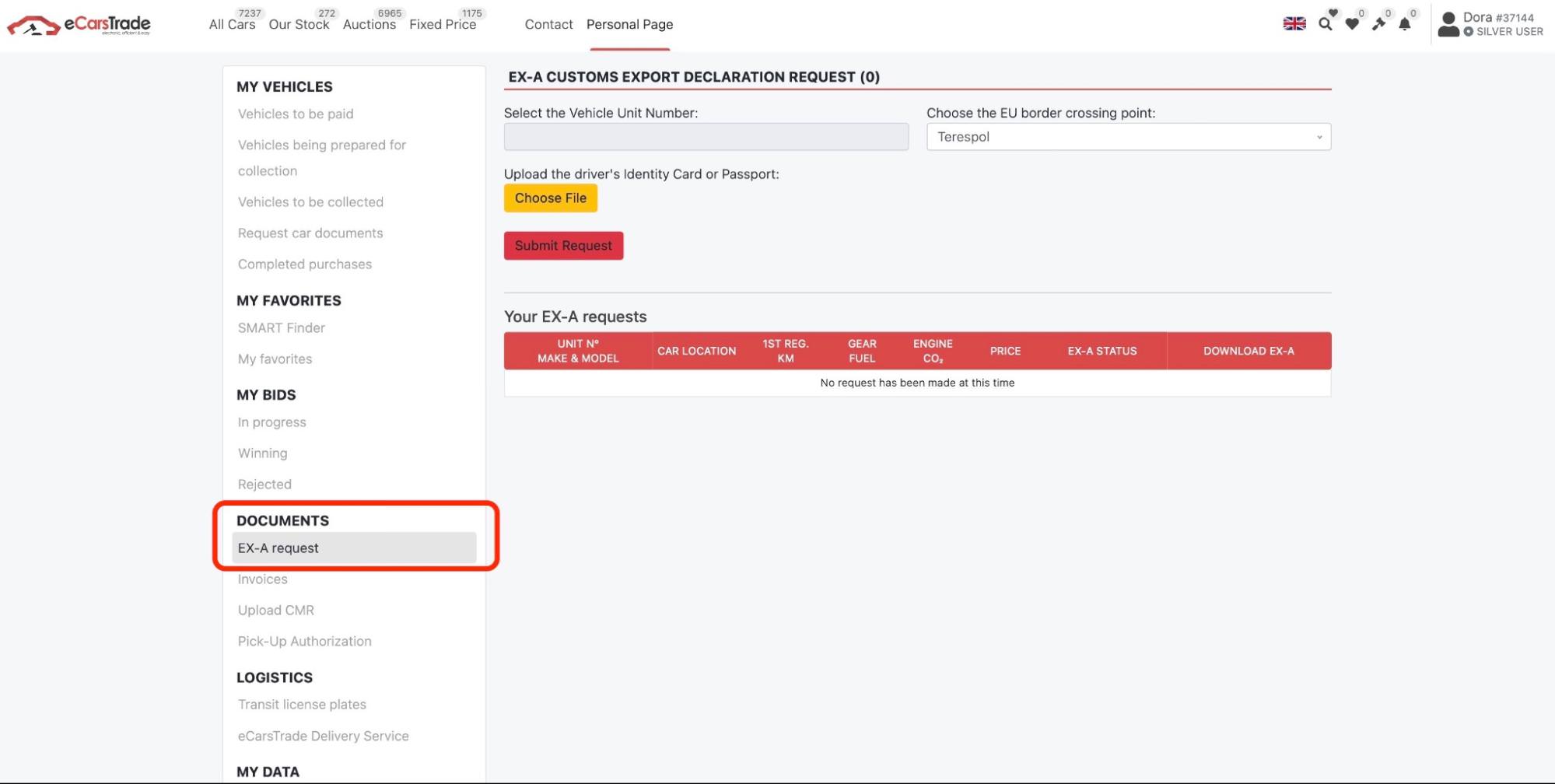

eCarsTrade lets you request the EX-A in the Documents section in your eCarsTrade profile.

Make sure to correctly indicate the EU border crossing point.

5. Go through customs

When your vehicle enters Bosnia and Herzegovina, you declare it at the border. Here, you’ll present:

- Vehicle purchase invoice

- Original registration papers

- EUR1 certificate if you have it

- EX-A export declaration

If everything is in order, you’ll receive a temporary customs clearance, which gives you six days to homologate the car.

6. Homologate the car

During the 6-day period, you need to take the car to an authorized technical service (a homologation centre) in Bosnia and Herzegovina.

They’ll inspect the car to make sure it meets the local technical and environmental rules.

Once the car passes inspection, the centre issues a homologation certificate, which is a document you need to complete the import process.

7. Follow the export status of the car

Non-EU buyers must usually pay a VAT deposit when buying a car in the EU.

On eCarsTrade, the VAT rate depends on the seller’s country. For example, you pay 21% if the car is sold from Belgium, like on eCarsTrade.

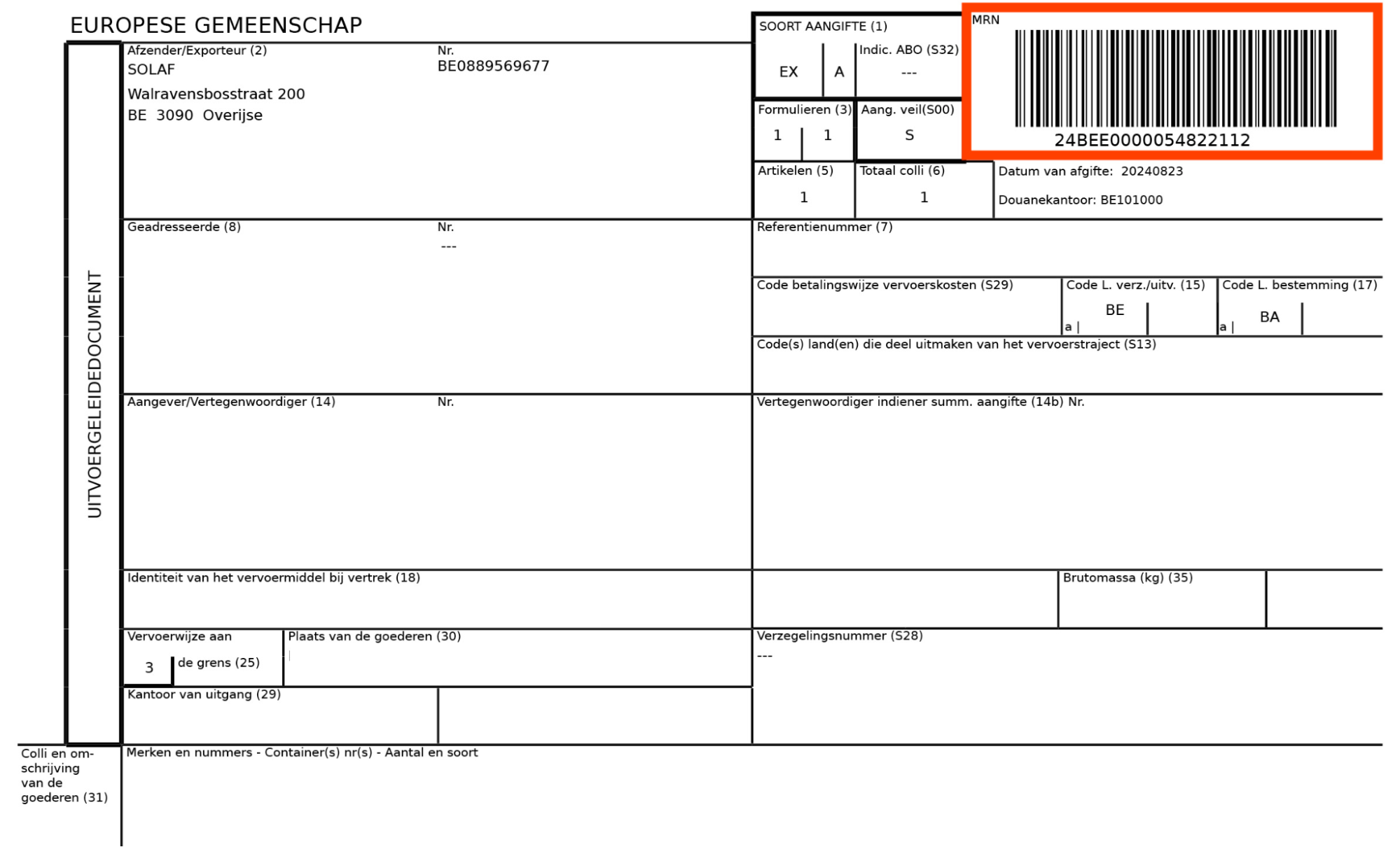

After the car leaves the EU, follow the export status via the MRN Follow-up website using your MRN number which appears on your EX-A.

After the customs confirms the export, the VAT is fully refunded. The refund is sent to the same account used for the purchase.

8. Pay VAT and customs duty

After homologation, you return to a customs office in the interior of Bosnia and Herzegovina to complete import clearance.

At this stage you pay all import charges:

- If you’ve provided proper proof of EU origin (EUR1 or statement of origin), and customs accept it, no customs duty is charged. If not, you’ll pay 15% customs duty.

- Regardless of duty exemption, you must pay 17% VAT (PDV) calculated on the assessed value of the vehicle.

9. Register the car

With a homologation certificate and customs clearance done, you can proceed to register the vehicle at an office of the Ministry of Interior.

Get to know the Bosnian used car market

Bosnia has one of the oldest car fleets in Europe. The average age of a car is around 17 years, and a large share of vehicles is older than 20 years, which creates steady demand for younger used imports from the EU.

In 2024, over 80% of all vehicles sold in Bosnia and Herzegovina were used cars. Clearly, demand for used cars is there, which is good news for car traders importing used cars from the EU.

Still, you should keep in mind that Bosnia has tightened its rules on imports, meaning that you can only import cars that meet at least the Euro 5 emission standard.

The new-car market is much smaller, but it shows what buyers like. In October 2025, the leading brands in new car sales were:

- Škoda

- Volkswagen

- Toyota

- Hyundai

- Dacia

- Audi

- Kia

- Renault

- Suzuki

- BMW

- Mercedes

For you as a dealer, this means that younger Euro 5+ Škoda, Volkswagen, Toyota and similar models from the EU are a safe choice when importing used cars to Bosnia and Herzegovina.

Importing a car to Bosnia and Herzegovina - FAQ

► Can I import any used car to Bosnia and Herzegovina?

No. Bosnia only allows the import of cars that meet at least the Euro 5 emission standard.

► Do I need the EUR1 certificate when importing a car?

You need the EUR1 certificate or a Certificate of Origin (or statement of origin) if you want to avoid the 15% customs duty on EU vehicles. Without these documents, you’ll pay the full duty at import.

Even if you obtain the EUR1, customs may still refuse the reduced duty, so plan your costs in advance and don’t assume they’ll automatically accept the document.

► Can I drive the car to Bosnia myself?

Yes, but you’ll need transit plates and valid insurance from the seller’s country. You could also ship the car via a transport company.

► How long do I have to homologate the car after it enters Bosnia and Herzegovina?

After the border declaration, you receive a temporary customs clearance that gives you six days to homologate the vehicle at an authorized technical service.

Import pojazdów z Europy może być skomplikowany, ale eCarsTrade jest tutaj, aby uprościć ten proces. Dowiedz się, jak: