- Blog

- How VAT Works When Buying and Importing Used Cars From the EU

How VAT Works When Buying and Importing Used Cars From the EU

Find when you can reclaim VAT on cars in the EU or when exporting. You’ll learn the difference between VAT deductible and margin cars, how VAT deposits work, and how to make sure your VAT refund goes smoothly.

Kluczowe wnioski

For EU buyers

- Paying VAT depends on whether the car is VAT deductible or sold under the margin scheme.

- VAT deductible cars: You pay the net price in the seller’s country and declare VAT in the country of import.

- Margin cars: You pay the full listed price with VAT included. There’s no refund or deduction, and VAT is only applied to your profit margin when you resell.

For non-EU buyers

- You pay the net price plus a VAT deposit to the seller.

- You get the deposit back after your export has been correctly registered by the EU customs officials.

- eCarsTrade can handle the EX-A declaration and VAT refund process, making compliance smoother.

Buying and importing used cars can be very profitable, and if you want to keep those profits high, you’ll have to understand taxes.

One of the most common questions that traders ask is: can I claim VAT back on a car? The rules for reclaiming value-added tax (VAT) on cars vary depending on whether you’re buying inside the EU or exporting outside, and the VAT mechanism that’s applied.

Fortunately, once you know the basics, it becomes much easier to plan your deals.

In this guide, we’ll explain how VAT works in car trading, how much you pay upfront, and when you can reclaim it.

We’ll start with used car sales between EU countries.

VAT mechanism in Europe

If you’re buying and selling within the European Union, the way VAT is applied depends on the system under which the car is sold.

The two main VAT mechanisms are:

- Standard VAT system - VAT is charged on the full price but can be deducted

- Margin scheme - VAT is already included in the price and you don’t pay it separately

Guide for EU traders purchasing from another EU country

Here’s an overview of each mechanism, along with how it works in practice on eCarsTrade.

► Standard VAT system - full price taxation and deduction

Cars are sold under the standard VAT system if the registration documents show that the vehicle was owned by a company, not a private person.

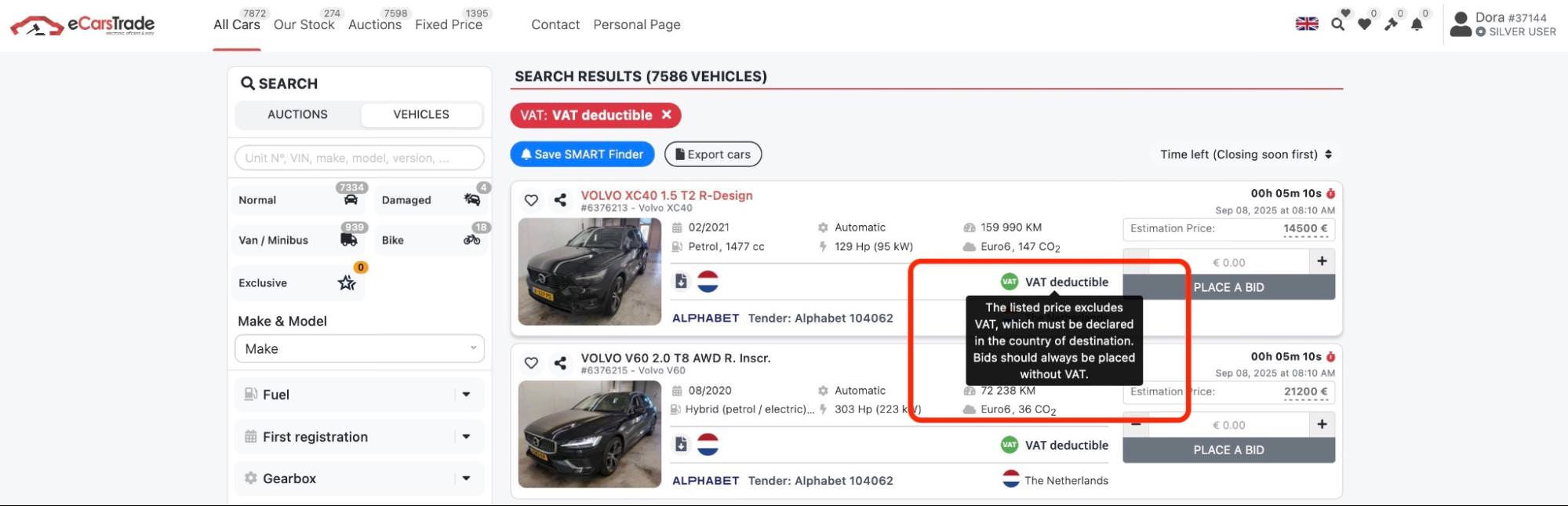

On eCarsTrade, these are marked as VAT deductible (or VAT excluded) cars. The price you see on the platform is the net price, without VAT.

So, when you buy a VAT deductible car in another EU country, you only pay the net price to the seller.

You don’t pay VAT in the seller’s country. Instead, you declare and pay VAT in your own country when you register or resell the car.

! Make sure that your VAT number is valid and activated for intra-EU transactions. In other words, that it’s enabled for cross-border trade within the EU.

You can check your VAT number’s status through VIES (VAT Information Exchange System).

And because you’re a VAT-registered business, you can also deduct the VAT you pay on this purchase from the VAT you collect when reselling the car.

You’ll make this deduction in your regular VAT return, depending on how VAT reporting works in your country.

In other words, VAT doesn’t stay as your expense, it’s passed on to the final customer.

► Margin scheme for second-hand goods

In addition to the standard VAT system, there’s also the margin scheme for secondhand goods.

Under this system, businesses don’t charge or deduct VAT on the full car price, as you can see in the European Commission’s rules on the margin scheme.

Instead, VAT is only applied to the seller’s profit margin.

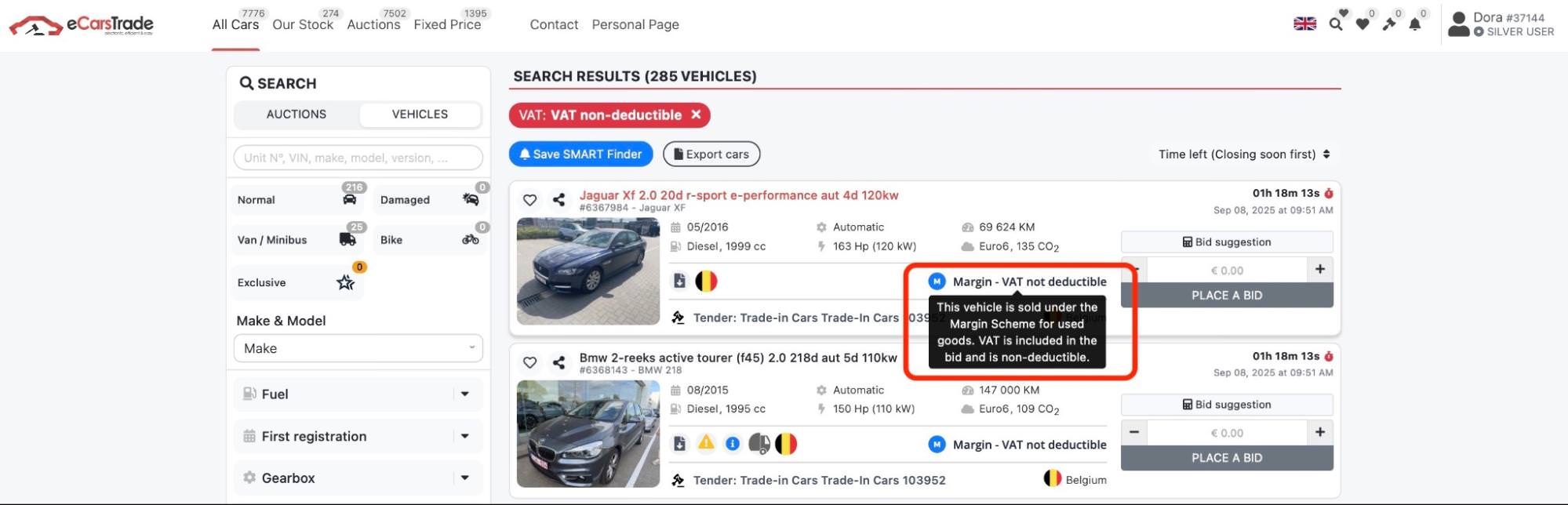

On eCarsTrade, some cars are sold under the margin scheme. These are marked as Margin – VAT not deductible cars. The price you see already includes VAT, and you can’t separate or reclaim this VAT.

When you buy a margin car, you pay the listed price in full. There’s no extra VAT to declare in your country. In the same way, you can’t deduct anything in this type of purchase.

Once you resell a margin car, you’ll only pay VAT on your profit margin (the difference between your buying price and selling price).

To sum up margin cars: the VAT is built into the price you see, but you can’t reclaim it.

Guide for non-EU buyers exporting from the EU

If you’re buying cars in the EU as a non-EU trader, VAT is handled differently. You’ll usually need to pay a VAT deposit when purchasing, and then request a refund once the car is exported.

Now, let’s see how this process works and what you’ll need for it.

VAT deposit system

If you’re buying cars in the EU as a non-EU buyer, you’ll first pay the net car price plus a VAT deposit to the seller.

The deposit is charged at the standard VAT rate of the seller’s country (for instance, 21% in Belgium). Once the car leaves the EU and you provide proof of export, the seller will refund the VAT back to you, so you’re not left with any extra costs.

Documentation needed for VAT deposit refund

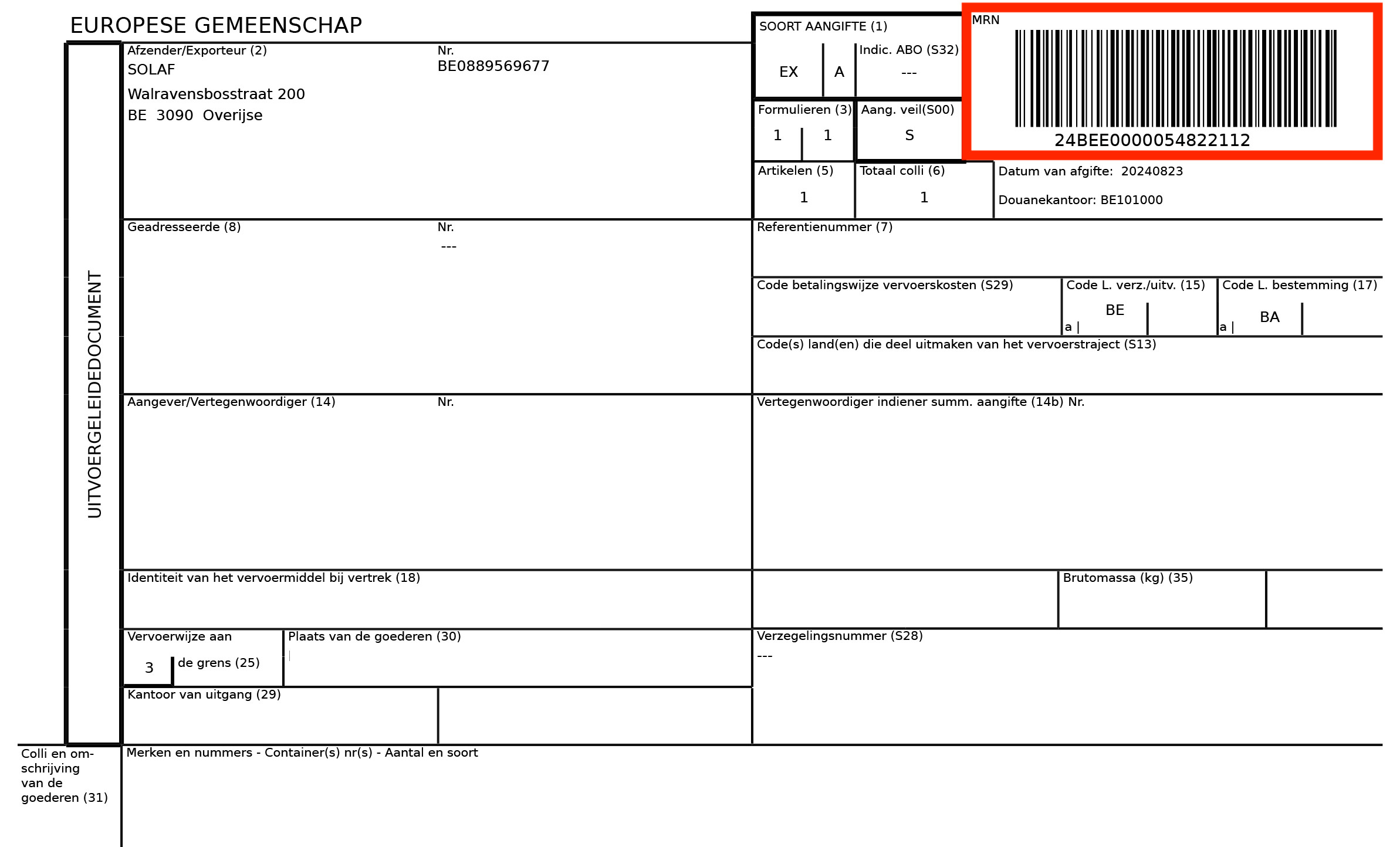

To reclaim your VAT deposit, you’ll need to prove that the car was exported out of the EU. You’ll do this with the EX-A export declaration.

This declaration is created before the car leaves the EU. You can only reclaim your VAT deposit once the EX-A is officially registered at the EU border inspection point.

You can follow the export status of the car through MRN follow-up where you can enter your Movement Reference Number (MRN).

Exporting vehicles with eCarsTrade

As you can see, handling VAT outside of the EU involves some extra steps.

But if you're buying through eCarsTrade, for example when exporting used cars from Germany, the process is much simpler. eCarsTrade can prepare the EX-A declaration for you, so you don't need to arrange it yourself.

Once the car crosses the EU border and you confirm the export status through MRN follow-up, simply send all the export details to eCarsTrade together with your bank details, and you’ll receive your VAT deposit back.

Because cross-border car sales are closely monitored, eCarsTrade follows strict compliance procedures to keep everything in order.

This way, your purchase, export, and VAT refund are all done safely and in line with EU requirements.

Distinction between VAT-qualifying/deductible VAT vs Margin vehicles

To help you plan your deals, here’s what VAT means for you in each scenario:

|

Buyer location |

VAT mechanism |

Price to pay to the seller |

Is VAT refund available? |

|

EU to EU buyer |

VAT deductible car |

First pay net price in seller’s country, then declare VAT in country of import |

No refund (deduction is handled in buyer’s VAT return) |

|

EU to EU buyer |

Margin car (VAT included) |

Pay full listed price, no deduction possible |

No refund, no deduction |

|

Non-EU buyer |

VAT deposit (at seller’s country VAT rate) |

Pay net price + VAT deposit, you can reclaim the deposit after export |

Yes, you can get refund after export is confirmed |

Since there are only three options depending on your location and the VAT mechanism, you’ll quickly get the hang of it and know exactly what to expect in each case.

And with clear labels on eCarsTrade, you always know upfront which option applies to you.

VAT on used cars - Know what to expect

Whether you’re buying within the EU or exporting outside, understanding how VAT works helps you plan deals more effectively and avoid unexpected costs.

With clear rules for VAT deductible cars, margin cars, and VAT deposits, you can trade confidently and keep your profit secure.

eCarsTrade oferuje internetowe aukcje samochodowe samochodów poleasingowych z Europy!