- Blog

- Regional Used EV Adoption Rates

Regional Used EV Adoption Rates

See where EV adoption is growing fastest in Europe and which markets offer the best opportunities for buying and selling used electric cars.

Did you know that Europe is the world’s second-largest EV market, second only to China?

But, Europe is still a large territory. That’s why we’ll break down the European market into regions and see how they perform in EV adoption.

Once you learn where adoption is the highest and what’s affecting the market, you’ll be able to make better decisions for your sourcing, pricing, and which used EVs to stock next.

Kluczowe wnioski

- EV adoption in Europe is growing, with Northern and Western Europe leading in both market share and sales volumes.

- Germany, France, the Netherlands, and Belgium have big EV sales and high market share, which makes them some of the best places to buy and sell used EVs.

- Incentives, better charging infrastructure, and more affordable EVs from China are helping the market expand further.

EV adoption rate in Europe

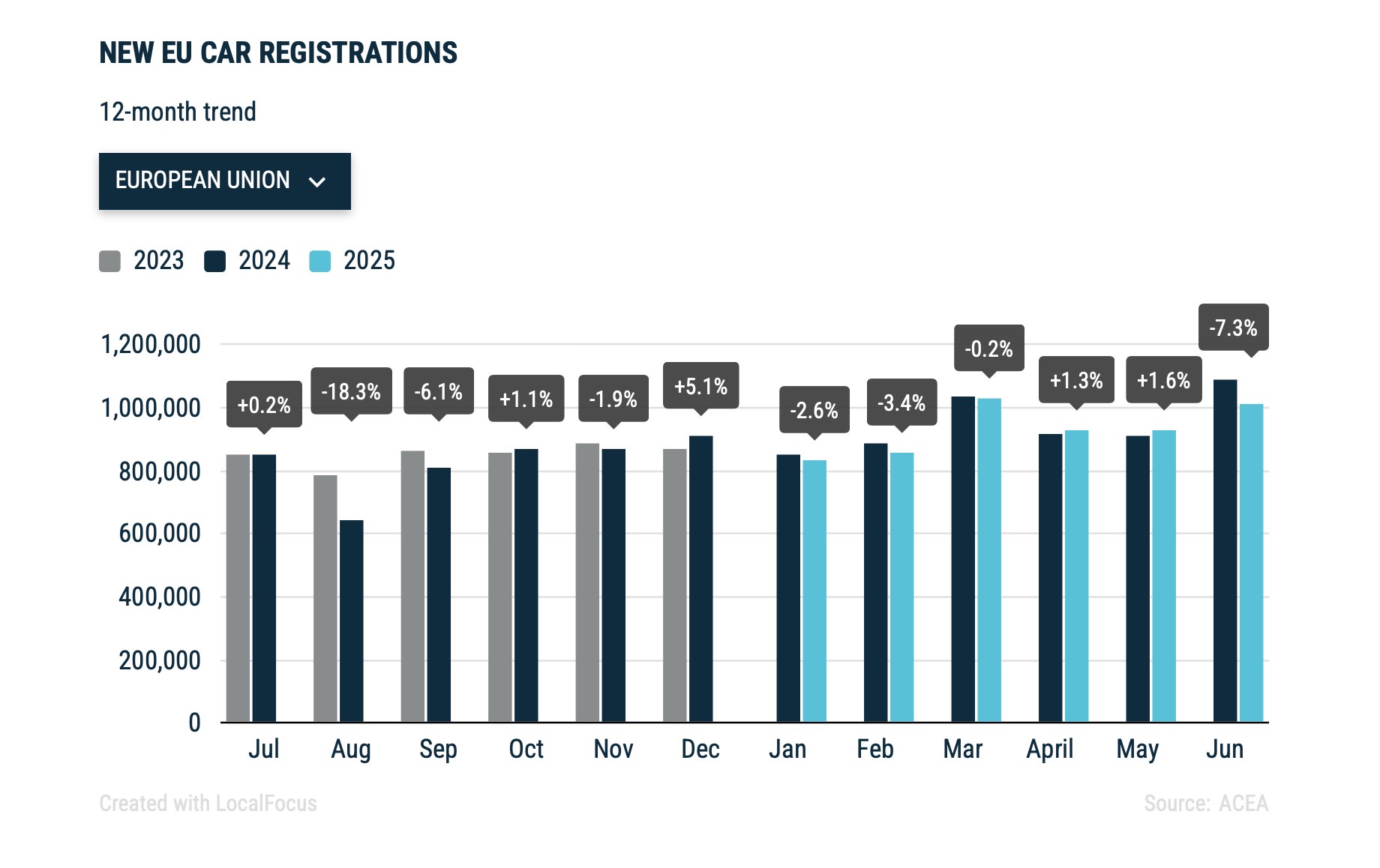

Before we compare region to region, let’s look at the overall car market. According to ACEA’s report on the first half of 2025, total new EU car registrations dropped by 1.9% compared to the same period last year.

Source: ACEA

Bear in mind that this refers to all car sales. Although car sales in general are flat, EVs are showing promise.

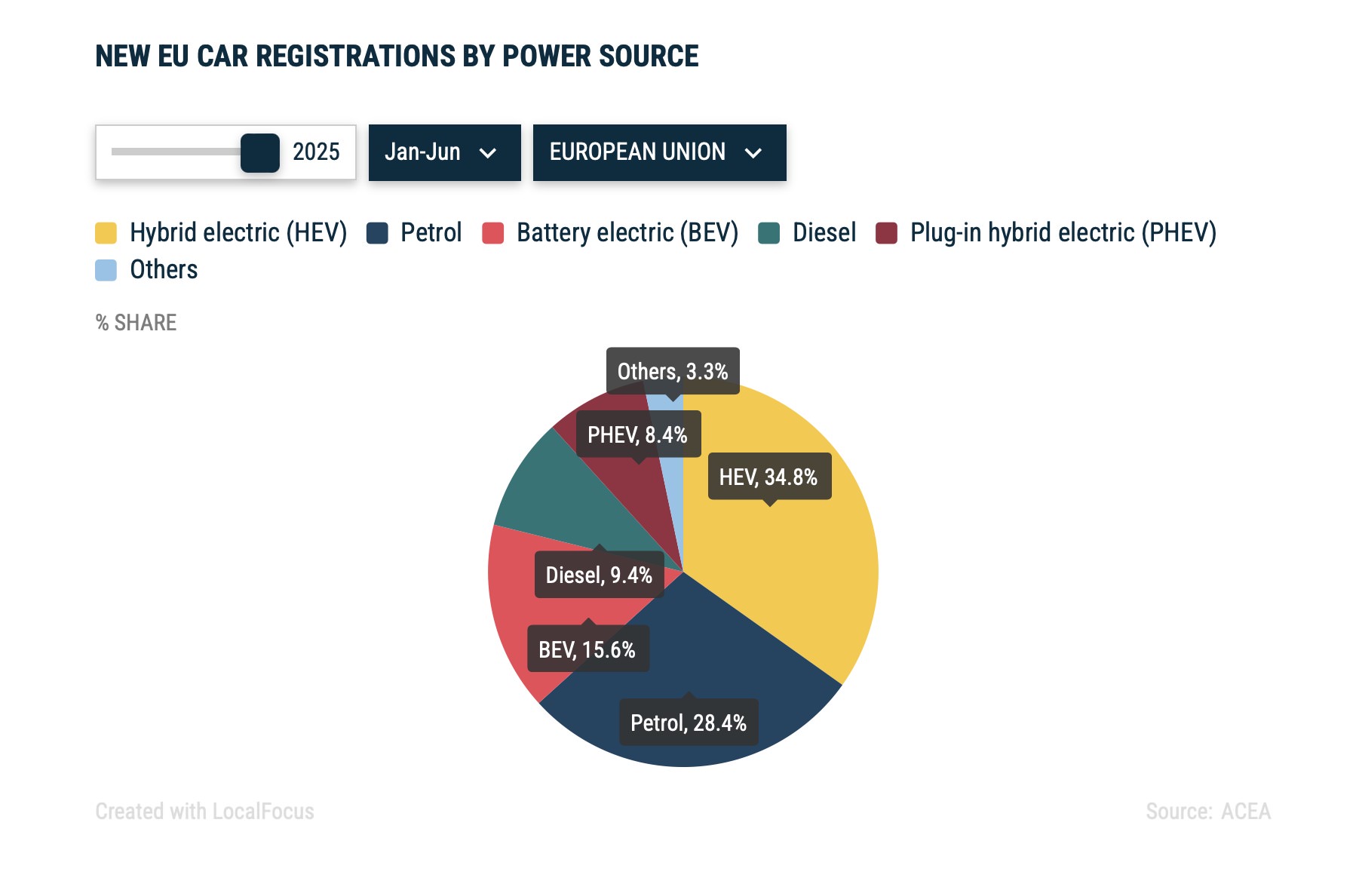

In fact, EV adoption is rising because EVs are taking a larger share of a stable market, with battery-electric vehicles making up 15.6% of new EU registrations in the first half of 2025.

Source: ACEA

To put it into terms relevant to used car traders, you can expect more recent BEV models to enter the used market between 2026 and 2028, thanks to today’s 15.6% share of new car sales.

Now, let’s see how this differs across Europe.

Northern Europe

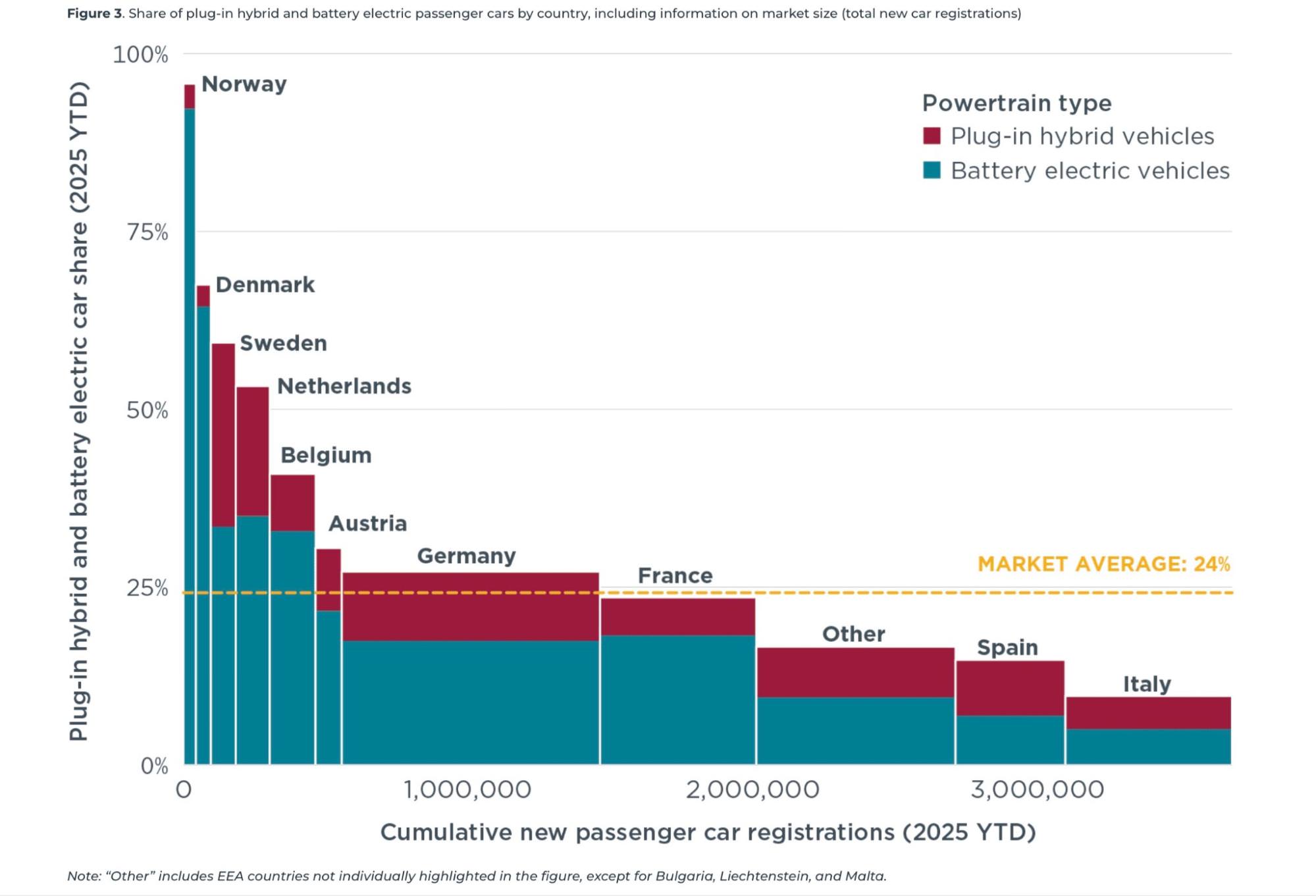

While Norway is not a member of the European Union, the country’s numbers show what a fully developed EV market can look like.

In the first half of 2025, as many as 93.7% of new passenger car registrations in Norway were battery-electric vehicles.

Among EU members, Denmark leads with 66% of new car sales being plug-in hybrids, which is more than double the EU average of 24%.

Sweden follows with a 60% plug-in share, and Finland is close behind at 56%, according to the European Market Monitor data.

Source: ICCT

These figures highlight how far ahead the Nordic countries are in electrification compared to most of Europe.

But while Northern countries have a bigger share of EVs on the market, Western countries sell more EVs in total because of their larger car markets.

Western Europe

Western Europe is a leader in EV adoption, both in EV market share and the speed at which the industry is growing.

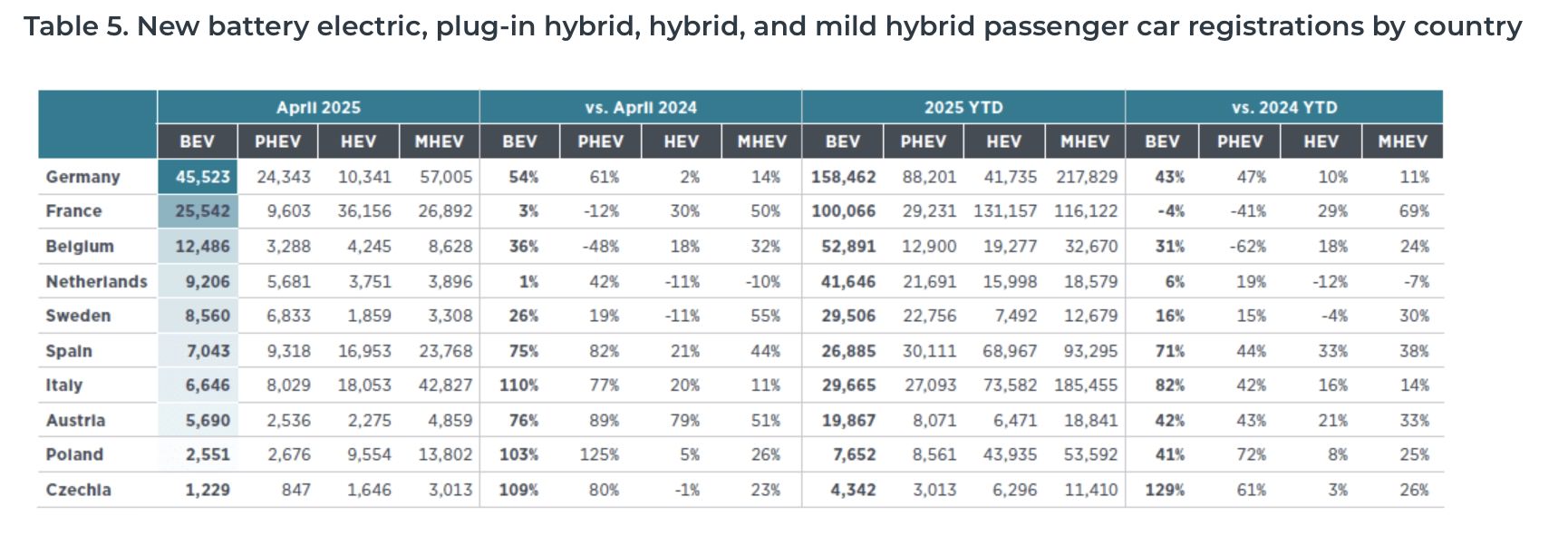

Countries like Germany, France, Belgium, and the Netherlands show strong sales volumes and yearly growth that’s above the EU average.

Source: ICCT

In terms of EV market share, ICCT data shows that out of Western European countries, the Netherlands has the biggest share with 34% of new registrations being BEVs.

Belgium follows with 32%, and Germany and France are there with 19% and 18% respectively.

All in all, Western Europe has both a high share of EVs and a large number of cars sold overall, so this is definitely an important region for Europe’s shift towards electric cars.

Southern Europe

In Southern Europe, EV adoption is still behind the rest of the continent, but it’s starting to increase.

Although these countries may represent smaller markets in the overall volume of car sales, they have still recorded strong growth compared to their own previous results. For example, in April 2025, BEV registrations rose by 110% in Italy, 109% in Czechia, and 103% in Poland.

So, although Southern European countries are below the European average in terms of BEV market share, they’re seeing some of the fastest growth rates in the region.

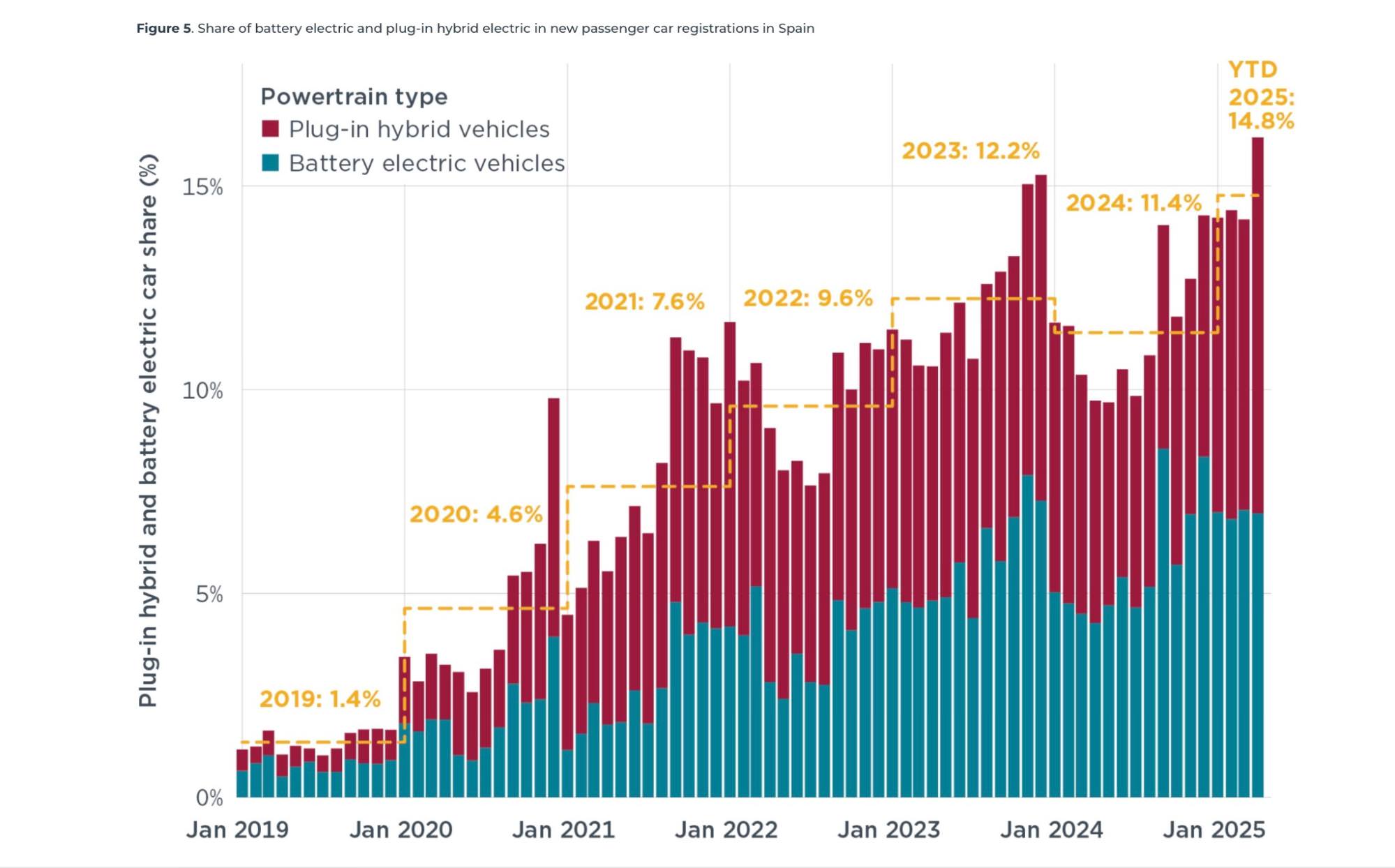

Spain is also a good example of this trend in Southern Europe.

EV share there has climbed to 14.8% so far in 2025, which is up from 11.4% in 2024.

Source: ICCT

Regional and national EV incentives are part of the reason for recent growth. Namely, the Reinicia Auto+ programme in Valencia and the renewed MOVES III scheme have boosted demand for EVs.

These measures lifted combined BEV and PHEV registrations by 55% compared to the same period in 2024, making Spain one of the fastest-growing EV markets in Southern Europe.

Eastern Europe

Electric vehicles still make up a small portion of new car sales in Eastern Europe. Still, some countries have been improving in EV adoption.

For instance, Hungary set a new monthly record for BEV registrations in March 2025, issuing 2,926 green plates. Note that green plates no longer include plug-in hybrids, meaning that every plate issued in this figure was for a fully electric vehicle.

Romania also saw growth in 2024, with sales of electric and hybrid cars rising by 25.1% compared to 2023. While BEV sales fell, there were more hybrids sold.

In other words, both countries are moving toward cleaner vehicle fleets, but in different ways: Hungary with record BEV registrations and Romania with a stronger shift toward hybrids.

Other Eastern European markets remain smaller.

EV hotspots - high-volume sales potential

When you’re identifying the best opportunities for selling EVs, it helps to look at both how big a country’s EV market is and how many EVs it sells.

Some countries stand out because a large share of their new cars are electric, while others have a lot of EVs simply because they sell a lot of cars overall.

Germany is an example of a country that has both. It has the biggest EV market in Europe by volume, and also a growing share of fully electric cars.

France is also a notable market, with EV registrations falling by 15% in the first half of 2025 but still making up 23.4% of all new car registrations, which is keeping the country among Europe’s largest EV markets.

The Netherlands is another strong EV market, with EVs making up 35.3% of new car registrations in the first quarter of 2025.

Belgium also ranks high, with EVs representing 31.3% of new car registrations in the first quarter of 2025.

So, these four countries combine either high EV market share, high sales volumes, or both, which makes them some of the best places to source and sell used EVs.

Strong demand for new EVs means a steady supply of recent models for the second-hand market, and good charging infrastructure and supportive policies help keep buyers interested.

EV market dynamics in Europe - Factors you need to be aware of

European EV figures are already good, but there are a few factors that could help the market grow even further in the coming years. Here’s what they are.

► Incentives and tax benefits

Many EU countries offer purchase subsidies, tax reductions, or registration fee exemptions for EVs, and you can find an overview of these incentives in our dedicated article.

These incentives play a big role in boosting demand, so make sure you check out which ones apply to your region.

► Density of the charging infrastructure

Europe’s charging network grew by 35% in 2024 compared to 2023, and there are now more than one million charging points.

The number of charging stations is expected to grow, which means that owning and driving an EV will become even more convenient for more people across Europe.

► Influx of Chinese EVs

Affordable Chinese-made EVs are entering the EU market, giving buyers more choice and lowering EV prices.

Don't ignore current EV trends - Buy with eCarsTrade

Reading about the upward trend of EV adoption in Europe might have made you consider adding more electric models to your stock.

On eCarsTrade, you can do that easily.

Simply filter your search by fuel type to see only electric vehicles, and you’ll instantly get a list of available models from trusted sources.

From there, you can place your bids and secure the cars that are ready to sell.

FAQ

► Which European country has the highest EV adoption rate?

Norway has the highest rate of EV adoption in Europe. Among EU members, Denmark, Sweden, Finland, and Germany have the largest shares of new electric car registrations.

► What percentage of cars in Europe are electric?

In 2024, electric vehicles made up about 23% of new passenger car registrations across the EU.

► Are used EVs worth buying in Europe?

Yes, they are. The prices are better, charging is widely available, and many used EVs have good battery health.

► How does Europe compare to China in EV adoption?

China sells the most EVs worldwide. Europe is second but growing steadily.

► What EV model is the most popular in 2025?

The Tesla Model Y is the best-selling battery-electric vehicle in Europe in the first half of 2025.